Investors often ask: Is now a good time to invest?

By IG Wealth Management • • 4 min

The real meaning behind the question is more likely that investors want to know if their investment will go up rather than down. In truth, it’s impossible to know when the “perfect” time to invest is. Rather, if investors are nervous about when to invest, we would suggest buying in regular increments — perhaps monthly or quarterly — as trying to time the market is an exercise in futility.

One of the main reasons to avoid market timing is that it’s incredibly difficult to predict when the market will rise or fall. Even the most experienced analysts and economists cannot predict market movements. By trying to time the market, you’re essentially trying to predict the unpredictable, and success is improbable.

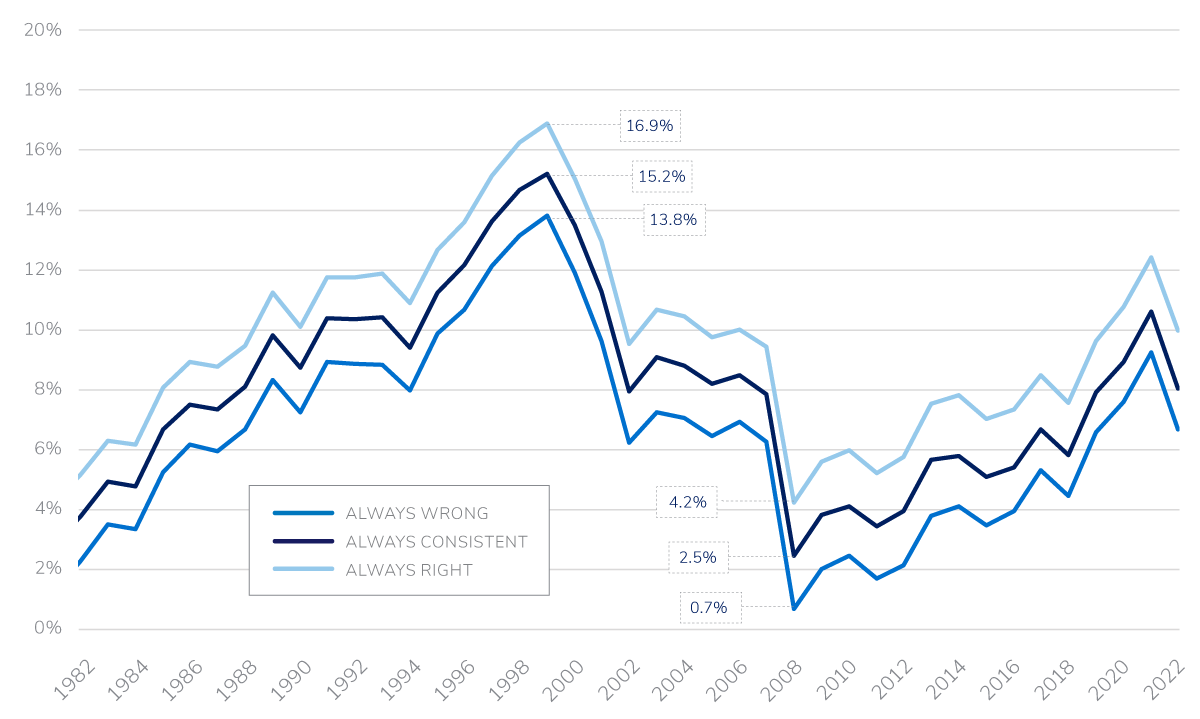

As an example, we assume three investors make annual lump-sum equity investments of $10,000 each year over 20 years. The first, let’s call him Always Right, times the market perfectly every year and buys at the market low. The second, Always Wrong, has terrible timing and invests at the market high for the year, every year. The third investor, Always Consistent, makes his investment on the last trading day of December, every year, like clockwork.

20-year rolling annualized return of lump-sum investments on the year’s low (Always Right), high (Always Wrong) or December 31 of each year (Always Consistent)

We looked at the historical outcomes of each investor on a 20-year basis from 1962 to 1982 and roll forward for every 20-year period ending 2022. The best 20-year period fell between 1979 and 1999. Yet the annualized difference in return between Always Right and Always Wrong was only 3.1%.

Looking at Always Consistent, he fell roughly in the middle. More importantly, the likelihood of timing the investment on the best trading day in a year is 1/250. To try and execute this perfectly for 20 years is a near impossibility — just as it is to have the worst timing every year.

Another point to consider is that trying to time the market can lead to emotional biases, such as fear of missing out (FOMO) or fear of losing money (FOLM), which can cause you to make irrational decisions.

Consistently investing in the market — either monthly or quarterly, regardless of the current price — can help you avoid these emotional biases and ensure a steady investment outcome.

This strategy may not be as exciting as trying to time the market, but it’s been proven to be the most effective way to grow your wealth over the long-term.

Talk to Our Team today about your investment portfolio.

Written and published by IG Wealth Management as a general source of information only. Not intended as a solicitation to buy or sell specific investments, or to provide tax, legal or investment advice. Past performance does not guarantee future results. Seek advice on your specific circumstances from an IG Wealth Management Consultant.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus before investing. The rate of return is the historical annual compounded total return including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, values change frequently and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). And additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

Insurance products and services distributed through I.G. Insurance Services Inc. (in Québec, a Financial Services Firm). Insurance license sponsored by The Canada Life Assurance Company (outside of Québec). Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations